Transparency

This report is made in order to align PAID S.A. with the requirements of Regulation No. 9/2019 for the amendment and supplement of the Regulation of the Financial Supervisory Authority (FSA) No. 2/2016 on the implementation of corporate governance principles by the entities that are certified, regulated and supervised by the ASF.

Download the document in PDF format

Taking into account the requirements of the regulations mentioned above, PAID S.A. publishes and regularly updates the information subject to the publication requirements.

A. Organizational structure

The management and administration structure of the company is made up by: General Meeting of Shareholders, the Management Board, the General Manager and the Deputy General Manager.

Shareholders of the company:

The 5 members of the Management Board are:

Executive Management:

At the level of PAID S.A., there are 8 Committees established: Risk Management Committee, Audit Committee, Damages Committee, Complaints Analysis and Settlement Committee, Investment Committee, Reinsurance Committee, Business Continuity Committee (BCP) and Remuneration Committee.

The persons holding key positions are: Head of Risk Management Department, Compliance Officer, Head of Internal Audit Department and Head of Actuarial Department.

Structural organization:

B. The main features of the governance system

The governance system includes organizational structures designed to support meeting strategic objectives and company's activity. PAID S.A. is properly and efficiently organized, and all necessary procedures and operational controls are implemented. Responsibilities are also clearly divided between the different operational areas of the company.

The company operates several systems that have the role of ensuring corporate governance, namely:

Also, at the company level, a series of policies and procedures were adopted and implemented, among which: policies for the smooth running of the activity, adequacy policies; remuneration policies; information security policies; outsourcing policy; Solvency II policy; and so on. They are regularly subject to the review and approval process, taking into account the nature, scope and complexity of the activities both at the individual level and at the level of the whole company.

The Company's objectives regarding the governance system are focused primarily on:

Further details on the corporate governance framework are available in the Solvency and Financial Condition Report (SFCR) Chap. B.(only in Ro)

C. Conclusions of the assessment of the financial position

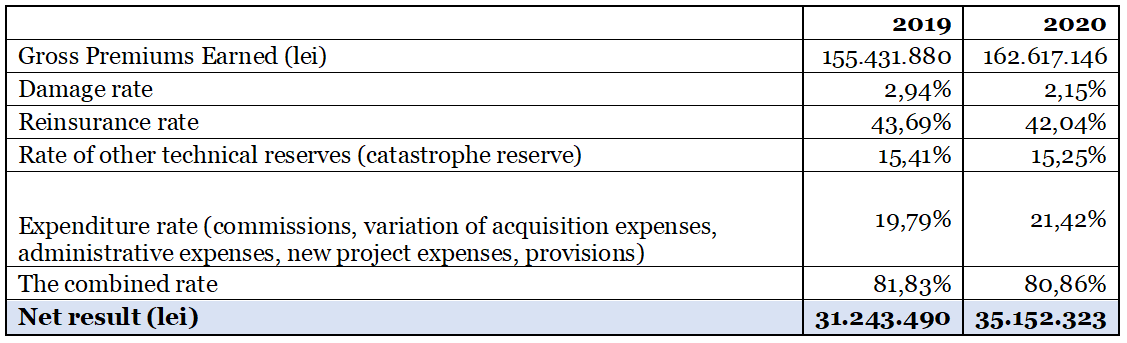

Main financial indicators of the company, according to the statutory accounting and financial reporting standards:

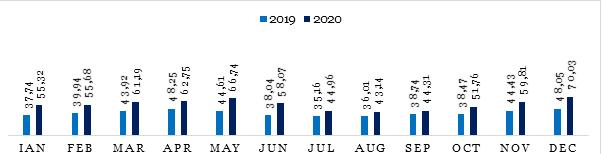

Evolution of the liquidity ratio:

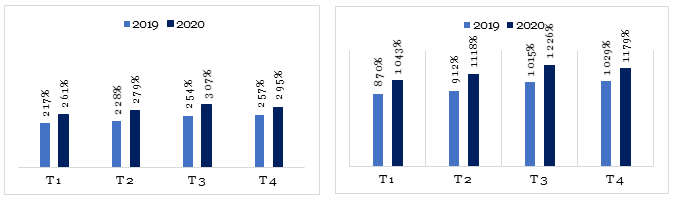

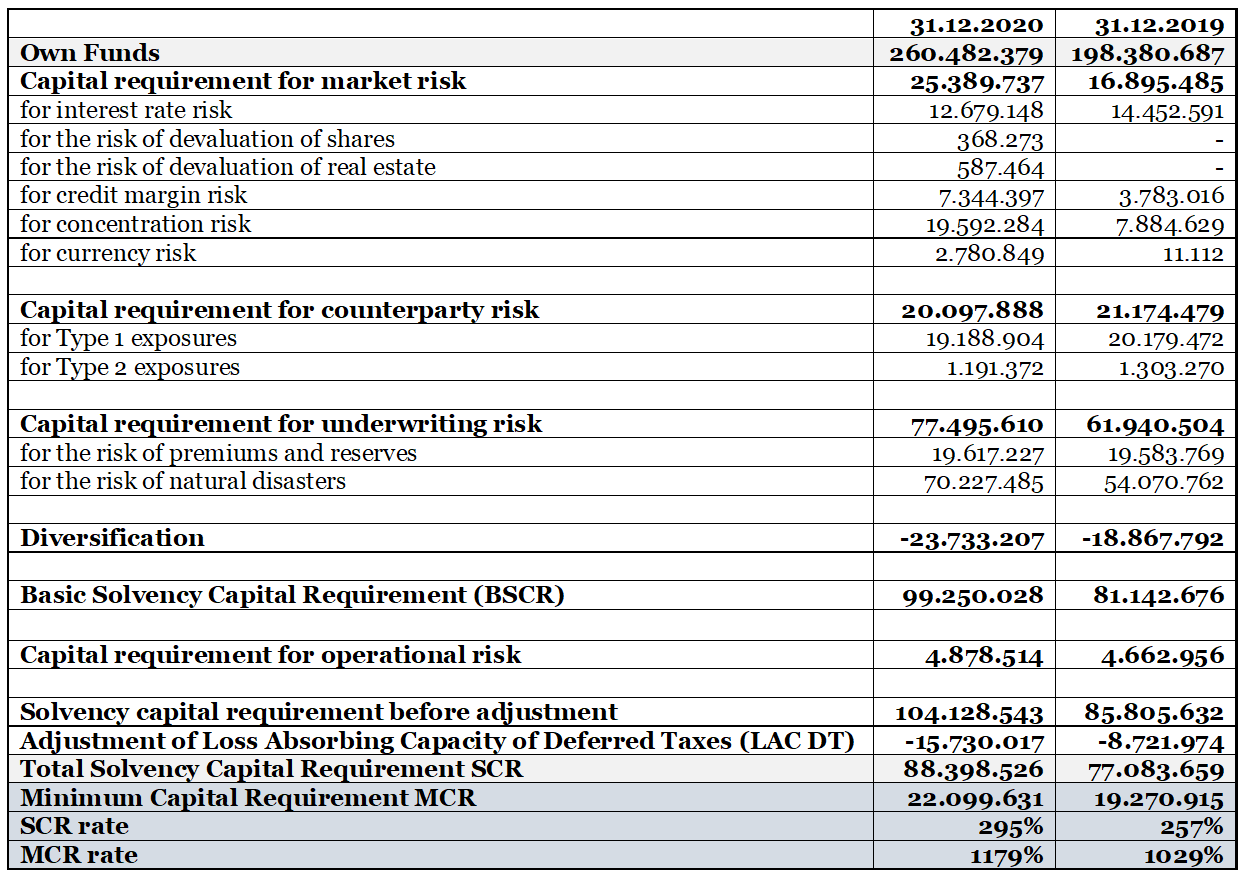

Main financial stability indicators of the company, in Solvency II reporting regime, calculated according to Standard Formula:

Solvency:

SCR coverage MCR coverage

To cover the risk of catastrophe, PAID S.A. had in force on December 31st, 2020 one of the largest reinsurance programs in Europe, in which 41 reinsurers participate. The program is of excess of loss type and has a maximum capacity of 950,000,000 EURO for earthquake, landslide and flood risks, its own withholding being limited to 8 million EURO for earthquake risk and 6 million EURO for landslide risks and floods.

Starting with June 1, 2021, the capacity of the reinsurance program was increased to 1,000,000,000 EURO.

D. Main features of the formal framework for the implementation of financial reporting principles and practices

PAID S.A. draws up statutory financial statements in accordance with Financial Supervisory Authority Rule No. 41/2015 for the approval of the Accounting Regulations on the individual annual financial statements and consolidated annual financial statements of entities carrying out insurance and/or reinsurance activities.

The annual financial statements are audited by an independent auditor. The financial statements package for the fiscal year 2020 was audited by Mazars Romania SRL.

In accordance with the provisions of ASF Rule No. 19/30.10.2015, the company draws up and publishes annual financial statements below IFRS standard since 2015 as parallel reporting.

Solvency Reports II (SII)

In accordance with the financial reporting requirements of Law No. 237/2015 on the certification and supervision of the insurance and reinsurance activity and of Regulation No. 21/2016 on reports on insurance and/or reinsurance activity, with subsequent amendments and supplements, PAID S.A. draws up and reports:

In addition, in accordance with the provisions of Solvency II, the Delegated Regulation and the Internal Policy, PAID S.A. draws up annually or whenever significant changes occur in the risk profile or appetite, a prospective own risk and solvency assessment report carried out at the level of the group (the ORSA report).

At the level of PAID S.A., the "Reporting Policy" has been developed and implemented, which aims to ensure the completion and timely transmission of all mandatory reports, as well as to ensure their accuracy and completeness.

The Audit Committee is the forum for approving statutory and Solvency II reports before they are submitted for approval to the Board of Directors and/or the General Meeting of Shareholders.

E. Main features of the risk management system

Management of the Risk Management System at the level of the Company is carried out through the planning, coordination and control of the Risk Management activity. It establishes specific strategies, develops policies and procedures for identifying, assessing, monitoring, managing/reducing and reporting risks in a timely manner, with the aim of optimizing them and creating a "risk awareness" culture.

The risk management system is subject to a continuous process of streamlining, with the aim of protecting the company by supporting its objectives, as follows:

The specific risk management strategy is an integral part of the Company's overall strategy, with the following as fundamental objectives: compliance with the capital requirements of SCR and MCR and ensuring an increased solvency rate, the achievement of an optimal reinsurance programme and efficient profit-oriented management and capitalisation, all with the unitary aim of maintaining the financial stability of the PAID S.A., so that all financial obligations to the Client are respected.

Each year, PAID S.A. draws up a Risk Plan presenting the objectives and measures for each significant risk, which is subject to debate and approval by the Management Board.

The PAID risk strategy is based on the following principles:

The company's main strategic objectives remain linked to the 4 pillars of sustainable development of the company, namely:

The activity of PAID S.A. is analysed in terms of exposure to the following risks: Underwriting Risk, Liquidity Risk, Credit Risk, Market Risk, Operational Risk, Reputation Risk and Strategic Risk. Risks are treated individually, but also collectively. PAID S.A. calculates the capital requirement using the Standard Formula. The results obtained provide an overview of how risks are distributed by different risk categories and determine capital and solvency requirements in accordance with Solvency II.

Based on the financial results of recent years, PAID is in the process of accumulating its own funds and optimising the capital requirement to ensure a more comfortable solvency rate.

Risk analyses are drawn up at company level in accordance with the specifications of risk policies and procedures.

The most important risks are:

More details on the risk management system are presented in the Solvency and Financial Condition Report (SFCR) Chapter B (subchapter B.3) and Chapter C.(only in Ro)

F. Conclusions of the assessment of the efficiency of the risk management system

Risk appetite and significance thresholds set within the management system are approved by the Management Board.

The Risk Management Function and, where appropriate, the Risk Management Committee reports the risk situation to the Management Board through a risk report.

Periodically, the Risk Management Department/Risk Management Committee presents to the Executive Management/Management Board the specific risk management indicators, their reporting to the benchmarks, proposes for analysis, debate and approval procedures specific to risk management, reports, Operational Risk Matrix, etc.

The management of the company considers that the risk management system is adequate, complete and adequately covers all areas of activity.